Unshakeable

After getting through the first few chapters which were very salesy and selfless promotion of Tony Robbins himself there is some gold for those who wants to understand the stock market.

Every market has its ebbs and flows, bull and bear markets. Our last bear market was in 2008-2009. We have not had a downturn in the market for seven years. We are well overdue. Winter is coming and when it does, and it will happen, don’t panic. Don’t go with the masses and focus on the short term losses. Every bear market turns around, the corrections are either big or small, it happens in 50 days or maybe 200 days but it will turn and rise again. Summer always prevails over winter. The book is to prepare you to be unshakable during this period.

A section of the book is particularly geared to a US audience, specifically speaking about who to invest your money with and where to invest your money. In a nutshell, don’t invest with stock brokers, they will send you broke. Invest your monies in a low transaction-cost index funds. They have a slow and steady approach to building wealth and the index funds will cost you less in fees.

It’s not what you earn, but what you keep that counts. It’s not what your gross earnings are per annum but what your net earnings are that matter. Let’s say you generate 10 million in gross revenue and your overheads are 9.99 million you don’t have much left to invest let alone live off. Create goals around your gross earns and net profit. Let me add to that it isn’t what you keep but what you do with what you keep that counts.

The world is uncertain; you don’t know what is going to happen around the corner. Your role is to find certainty in an uncertain world no matter what cards you are dealt. This very important to Tony which is birthed from the void of having very little certainty as a child growing up.

WHAT’S YOUR Growth Ceiling?

Growth Ceiling Definition: Invisible barriers, challenges and problems preventing you from levelling up

Fact: All business problems are personal problems in disguise

Take Our Maximum Growth Quiz To Identify Your Growth Ceiling:

Never underestimate the awesome power of disciplined savings combined with long term compounding. Set a goal to have three or six months of income and have the ultimate goal of seven years. Love this idea of having a cushion, but continue to raise that cushion beyond three months of liquidity. Set a goal and continue to raise the bar. Use compounding interest as your friend.

Neuroscientists have found that the same part of the brain that processes financial losses is the same part of the that responds to mortal threats. No wonder people panic when they lose money.

Let’s say that you are in the market and there is a crash which happens every three to five years, it’s the

same as a saber tooth tiger trying to attack you. Your flight or fight response is activated when you are losing money. Of course you want to take your money out and run. There are patterns in the market, the bear markets create a needed correction. These are inevitable. They may drop over a 50-day period but like in 2008, they returned 200% stronger within 6 months.

Creating wealth is 80% psychology and 20% mechanics. Learn the mechanics and create the right wealth mindset. Have a plan and strategy to mitigate the fear and protect us from ourselves. Follow the plan.

This is a tip from a guy who won a Nobel Prize for his work on modern portfolio theory. Big mistakes small investors make is to buy on the assumption that the market is going to go up and sell when the market is going down on the assumption that the market will go down further. Today’s winnings come from tomorrow’s losses. How true! Buy in the market with elation you are above and the universe brings you back into balance with a loss. Like Warren Buffett says “If you can’t manage your emotions, you can’t manage your money.”

The stock market is a device for transferring money from the impatient to the patient (Buffet). Be patient wise ones (me).

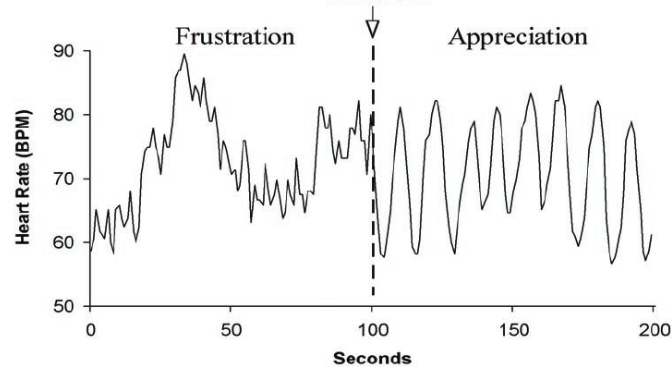

This brings us back to the brain again. More specifically when the share markets go up you get a dopamine rush. You may as well be having a line of cocaine. Market goes down you then get withdrawals, frustrated and depressed. Look at your stocks again, up again, another rush, another hit. You are like a fat kid in a candy store so you need to move away from the candy store.

Find fulfilment in what you have even if the outer world isn’t what you hoped it would be because you might find that you have fortune but it hasn’t made your life any better. Riches aren’t just about financial riches but riches in your career, your family life and your health. Find more in your life to appreciate.

with gratitude,